Passive note-takers, beware. Ed Gamber is having none of that in his classroom. He describes himself as “relentless when it comes to asking questions,” and strives to enable students to take control of their own learning.

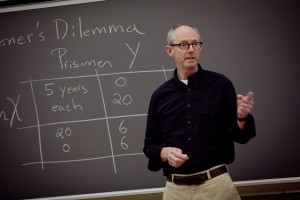

Ed Gamber, David M. '70 and Linda Roth Professor and head of economics

“I try to create an atmosphere where everyone can contribute to the discussion every class period,” says Gamber, David M. ’70 and Linda Roth Professor and head of economics. “I try to make them comfortable with being put on the spot and expect them to be active and engaged participants in the learning process.”

With the state of the world economy, there is much to discuss. Everyone—from colleagues standing around the water cooler to the talking heads on television—wants to debate the economy. Gamber points out that although the Great Recession ended roughly three years ago, the economy has grown at an unusually slow pace. An important factor in this slow recovery, Gamber says, is the financial crisis and drop in housing prices that preceded the recession. It was a ripple effect, as the housing drop dampened consumer spending and banks became reluctant to lend. And the struggling European economies certainly haven’t helped.

As far as a fix, there’s no magic bullet.

“We have actually done a lot of things to keep the recession from being deeper and the recovery from being slower, especially in terms of monetary policy,” says Gamber, who earned master’s and Ph.D. degrees at Virginia Tech. “In terms of fiscal policy, the economy needs more short-term stimulus, along with a strong commitment to long-term budget deficit reduction.”

Gamber has been at the College since 1992, except for a two-year hiatus when he worked as a forecaster for the Congressional Budget Office, forecasting short-term movements in the economy. That was when he became interested in the role forecasts play in policy decisions, which has become the focus of much of his research. The projects he’s working on now all explore how the Federal Reserve’s decisions about monetary policy depend on how it views the economy evolving over the next six to 24 months.

Along with Julie Smith, assistant professor of economics, and Jeff Liebner, assistant professor of mathematics, Gamber is measuring inflation persistence in the United States over the post-World War II period. Previous researchers may have overestimated the amount of inflation persistence by not taking full account of changes in the Federal Reserve’s behavior. The Fed controls inflation over long periods of time, but inflation over the short term moves around for reasons, or “shocks,” unrelated to the bank’s actions. It’s up to the Fed to assess whether to respond to such shocks. The team’s preliminary results suggest that inflation persistence has changed over the post-World War II period and tends to coincide with institutional changes by the central bank.

Gamber and Smith also are co-authors of a paper with Raluca Eftimoiu ’10 on headline inflation. The research is a continuation of an honors thesis started by Eftimoiu, who graduated with a B.S. in mathematics and an A.B. with a major in economics and business. Headline inflation, such as the consumer price index (CPI), is the rate reported most often in newspaper headlines versus core inflation, a measure of inflation that strips away volatile and transitory price movements to isolate the underlying trends, such as the consumer price index less food and energy (CPILFE). While both types of inflation tend to move together over long periods, they often diverge over shorter periods. Gamber and Smith are looking at whether periods of divergence are followed by core inflation moving toward headline inflation or headline inflation moving toward core inflation. So far, their evidence suggests that the answer to this question depends on whether the Fed responds to temporary shocks.

Gamber and Smith also are working on a comparison of the accuracy of Federal Reserve forecasts and professional forecasts. They are trying to gain more insight into the Fed’s relative forecast accuracy by examining the entire distribution of forecasts. The Fed’s forecasts, known as “greenbook” forecasts, are important factors in determining monetary policy. Dylan McNamara ’11, who graduated with a B.S. in mathematics and an A.B. with a major in economics and business and is pursuing a Ph.D. at the University of Michigan, worked with them on the project for two years as an EXCEL Scholar. They are co-authors of the paper, which will be published soon in an academic journal. Gamber and Smith also advised McNamara’s honors thesis.

Kelly Liss ’13 (Oakland, N.J.), a double major in English and economics & business, is helping Gamber put the finishing touches on all three projects. Including students in research is an intense extension of his commitment to challenging students inside the classroom. He wants students to move from mere consumers of knowledge to producers of knowledge, and publishable research is an ideal way to do that.

“My primary mission is to teach students to be lifelong learners and to develop an insatiable hunger for understanding the world around them,” says Gamber, a past recipient of the Lindback Distinguished Teaching Award. “When students become involved in research, they move beyond asking, ‘What do I need to know?’ and start asserting, ‘I need to know.’”

1 Comment

Though my interest lie in engineering…great article and insight to the Lafayette Experience!

Comments are closed.